Below, we delve into why we think child welfare is an important long-term investment theme with a strong impact on people and planet – and how the Triodos Future Generations Fund is a great way to gain exposure. But keep in mind that this is not advice or a recommendation to invest. All investments involve the risk that you could lose money and not get back as much as you invest.

Putting child welfare on the agenda

It’s cliché, but children are the future of the planet. And yet, they’re often overlooked in sustainable investing, the corporate agenda and government policies.

It’s not just climate change compromising the future of our planet, there are issues affecting children right now that will impact society for many years to come. There is child poverty across the world, many children do not have equal opportunities in life simply due to the place where they were born. Around 13,800 children under the age of five die every day, mostly from preventable causes. Nearly 60 million children worldwide do not receive primary education, and 63 million lack secondary education.

As part of a transition to a fairer and thriving society, we want to see organisations focus more on the welfare of children. Investing in child safety and development today will bring about wider benefits for society, both today and tomorrow.

Investing in children today might be the trend of tomorrow

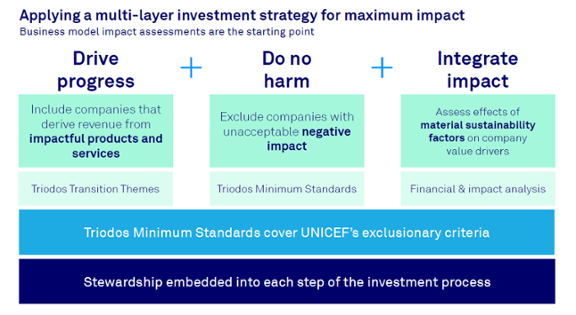

Triodos Future Generations Fund invests in companies that are considering the welfare of children and adding benefit for future generations through their products and services, but also in the way they work. In our opinion, there’s a strong impact and investment case for organisations that take future generations seriously. We believe that pioneers in this area will create long-term benefits for society that will ultimately be recognised as an important investment trend, and early investors in this theme could stand to benefit.

“Companies that focus on solutions to improve the position of children now and in the future also offer an attractive investment in terms of return,” argues Sjoerd Rozing, Fund Manager of the Triodos Future Generations Fund. “This makes child welfare and the wellbeing of future generations a good investment theme." However, it’s important to remember that no one knows what will happen in the future and returns are not guaranteed.

Selecting pioneering companies for positive impact

“The way I think about investing in child wellbeing is twofold,” says Rozing. “First there are the companies that contribute to solving the challenges that young people face right now. OrthoPediatrics is a great example. They are the world's first company to produce orthopaedic devices specifically for children. Until recently, medical practitioners had to improvise with medical devices designed for adults, which was problematic as children’s bones are growing. OrthoPediatrics has overcome this challenge by producing tailored medical devices that put children front and centre."

“Secondly, children are most at risk from long-term, wide-reaching threats like climate change, loss of biodiversity, and societal inequalities. So, we want to invest in companies that address these issues as well, such as companies that produce renewable energy, clean drinking water and reduce waste.

For example, sanitation is important for all, but it is especially important for children. According to UNICEF, each day over 800 children under the age of five die from preventable diseases caused by a lack of clean water, sanitation, and poor hygiene. That’s why the fund invests in companies like SABESP, a Brazilian water utility company which accounts for 30% of the investment made in basic sanitation in the country. In Brazil, 39% of all schools lack basic hand-washing infrastructure so this investment has a significant impact on children’s welfare."

Investing in smaller companies for big impact

Triodos Future Generations Fund focuses on small and medium-sized (midcap) businesses that we have strong conviction in.

When looking for solutions to address the world’s most pressing challenges, especially in impact investing, it is easier to find companies focused on a single product or a single service, as is often the case with small and midcap companies. These small and midcaps are an attractive way to get exposure to a single investment theme or angle, such as child welfare.

Moreover, smaller companies with a strong and viable strategic proposition can have fantastic growth potential, giving them the opportunity to be the big players of tomorrow. Remember with smaller, entrepreneurial businesses, there’s also more risk that the business might not perform as well as expected. If they decrease in value, investors could get back less than they put in.

Inspired by UNICEF

The strategy of the Triodos Future Generations Fund is inspired by the five areas related to children’s rights and wellbeing outlined in UNICEF’s Strategic Plan. These include access to affordable food and healthcare, access to education, promoting equality and inclusion, a clean and safe environment to grow up in, and freedom from exploitation, abuse and poverty.

Not only that, Triodos Investment Management (the investment arm of Triodos) donates an amount equal to 0.10% of the fund’s net asset value each year to UNICEF to support important projects. This is a voluntary donation by Triodos which will not affect the performance of the fund for investors.

Please note that UNICEF has no role in the development, management or operation of the Triodos Future Generations Fund, including its investments decisions. UNICEF does not endorse any investment adviser, investment, company or product, and makes no recommendation as to investment in the Triodos Future Generations Fund. Please see full disclaimer below.

Neither UNICEF, nor its partner in Luxembourg, Comité luxembourgeois pour l’UNICEF, is acting as an investment adviser and neither of them has had or will have any role in the design, structuring, development, management or operation of the Triodos Future Generations Fund. UNICEF, and the Comité luxembourgeois pour l’UNICEF, have not been and will not be involved in the management of the Triodos Future Generations Fund, including its investments decisions. Neither UNICEF nor the Comité luxembourgeois pour l’UNICEF has endorsed Triodos IM, Triodos SICAV I, the Triodos Future Generations Fund or any investment by the Fund. UNICEF and the Comité luxembourgeois pour l’UNICEF make no recommendation as to investment in the Triodos Future Generations Fund. The sole role of UNICEF, and the Comité luxembourgeois pour l’UNICEF, is to receive the donation from Triodos IM and apply such donation to UNICEF’s programmes for children. UNICEF and the Comité luxembourgeois pour l’UNICEF will have no liability to the Triodos Future Generations Fund or investors in the Fund in relation to investments in the Fund, the performance of the Fund or otherwise in connection with the Fund. UNICEF is immune under international law from every form of legal process.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.